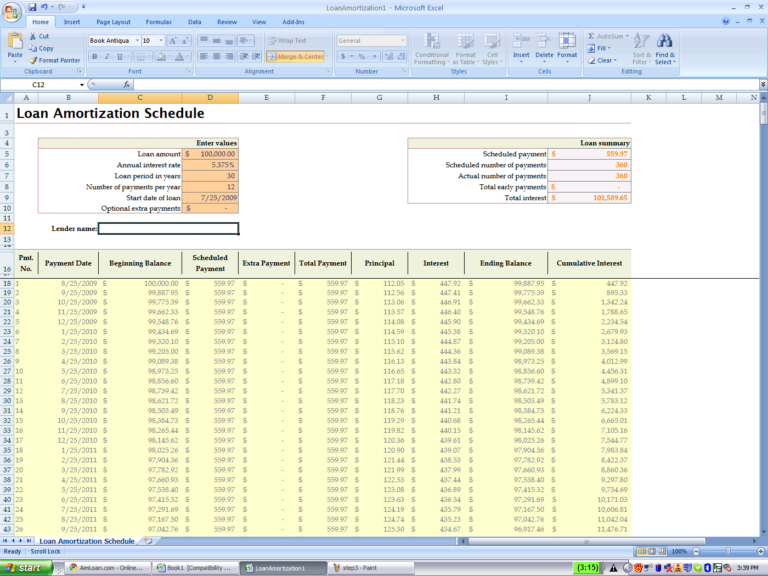

You can use the simple and quick IDFC FIRST online personal loan EMI calculator to get the job done in minutes. When you plan to take a loan online, you should review your current financial commitments and income to arrive at a suitable loan amount and affordable EMI values. Usually, the loan tenure options will be set by the lender and will be between 12 months and 84 months. However, with a longer tenure, you may end up paying more interest in total. Longer tenures lead to smaller EMI values. Loan Tenure: The loan tenure varies inversely with the EMI.The financial lender will determine your loan’s interest rate based on several factors such as your income, your repayment capacity, and your credit history. The higher the rate of interest, the greater will be the EMI value. Rate of Interest: The rate of interest is directly proportional to the EMI.The maximum loan amount you can avail, will be set by the financial lender based on your repayment capacity, relationship with the lender/institution, and other factors. 4 Star Trailers, 7 Sons, ABI Attachments Inc, Adams, Advanced EV PTV. Loan Amount: Higher the loan amount, the greater the EMI value.Similarly, a shorter tenure will lead to greater EMI values. The longer the tenure, the lesser will be your EMI values. You will then receive a chart showcasing the different EMI values for the number of years of tenure, based on the interest rate, and principal amount. You will have to carry out the following steps: 7,00,000 for a repayment tenure of 5 years at an interest rate of 12 per cent per annum. Suppose you are looking for a loan amount of Rs. Let’s take an example of how an online loan EMI calculator works when you enter the relevant information. You can adjust the variables according to your requirement. 377.42 × 60 months 22,645.20 total amount paid with interest. This calculation is accurate but not exact to the penny since, in reality, some actual payments may vary by a few cents. What would my loan payments be The loan amount, the interest rate, and the term of the loan can have a dramatic effect on the. Increasing the interest rate or loan amount will increase the EMI value while increasing the tenure will reduce the EMI value. Total interest paid is calculated by subtracting the loan amount from the total amount paid. The term (duration) of the loan is expressed as a number of months. If 'Start-of-Period' is selected, then the first payment will be due on the loan date. With the default selection, 'End-of-Period', the first payment will be due one month after the loan is made. It will automatically take care of the calculations for you. The 'Payment Method' determines when the first payment is due. You can just enter three key values – term, loan amount, and interest, into the calculator. You don’t need to know complex formulae to calculate your monthly payments.

0 kommentar(er)

0 kommentar(er)